What is a social trading account?

Social trading accounts are a unique and exciting feature offered by Moon4Traders. Simply put, social trading allows you to follow and copy the trades of other traders on the platform. This means you can learn from experienced traders and potentially profit by replicating their successful strategies. With social trading, you can also interact with other traders, ask questions, share ideas and strategies, and build a network of people with similar interests. In addition, you can use the social trading platform to track and analyze the performance of the traders you follow, and adjust your own strategies accordingly. Social trading accounts are an excellent way to improve your trading skills, learn from others and potentially profit in a more collaborative and social trading environment.

Benefits for beginners

- Join the success of consistently profitable traders. They already know how to make money in the market.

- Save time on education. Simply choose those who know how to trade.

- Learn from the pros, all their offers will be copied to your account. Analyze all entry and exit points. Learn how they do it.

- Open your own positions and copy trades from one account: you don't need 2-3 or more accounts. Copy trades from masters and open your own positions in the same account.

What is the difference between a PAMM and a MAM account?

PAMM (Percentage Allocation Management Module) and MAM (Multiple Account Manager) trading accounts are two types of managed trading accounts that allow several investors to pool their funds and invest in the financial markets. However, there are some differences between the two.

A PAMM account is managed by a single money manager who trades on behalf of all investors in the account. Each investor has a percentage share of the account’s equity, and gains and losses are allocated to each investor based on his or her percentage share. The money manager has full control over trading decisions and can execute trades for all investors simultaneously, using the same trading strategy.

On the other hand, a MAM account is managed by a trader who has the ability to execute trades on several individual accounts using a single master account. Each investor has his own individual account with his own funds, and the trader manages all the accounts together using the same trading strategy. In a MAM account, the trader has more flexibility to adjust the trade size and risk allocation for each individual account, depending on the investor’s preferences.

In summary, while both PAMM and MAM accounts offer investors the opportunity to invest in the financial markets through a managed trading account, the main difference lies in the level of control the money manager or trader has over trading decisions and risk management, and the allocation of profits and losses to individual investors.

How it works:

The experienced trader opens a master account and trades on it.

Our platform collects all business statistics in DataBase.

The master account appears on the leaderboard where investors can find it and subscribe if they like its statistics.

After subscription, all new master positions will be copied to the investors' accounts.

1. First you will need to have available funds deposited into your fiat USD wallet, if you have not done so already check our guide on “how to deposit”.

2. Login to your account at https://broker.moon4traders.com/login

3. To subscribe to a Social Trading account like copy trading, PAMM, or MAM, follow these steps:

- Create a payment account as a bridge to your investment account.

- Visit https://broker.moon4traders.com/home.

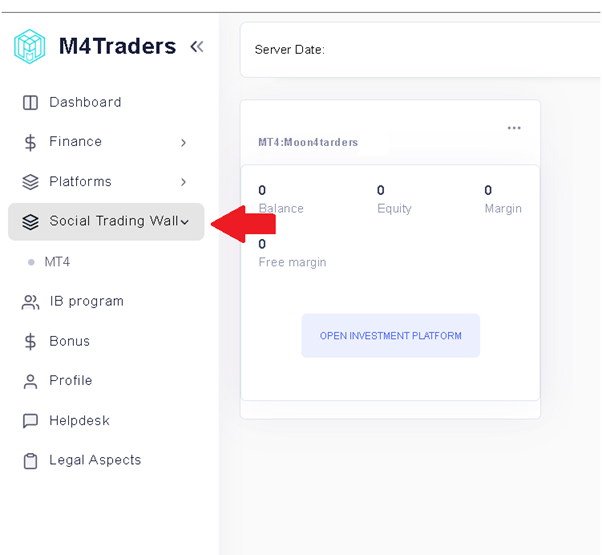

- Click on “Social Trading Wallet.”

- Select “MT4.”

- Finally, click on “Open Investment Platform.”

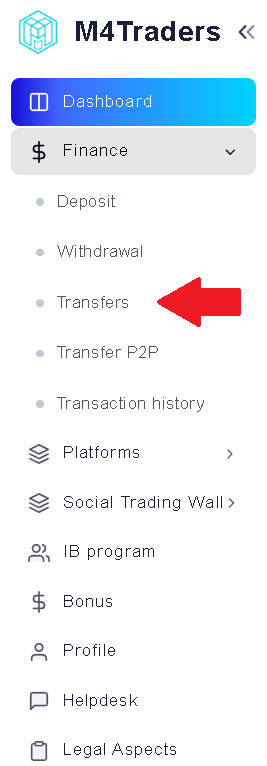

4. Now that you have created a payment account, you can now transfer funds from your fiat USD wallet to your new payment account. First click on the “Finance” tab on your dashboard and click on “transfers”.

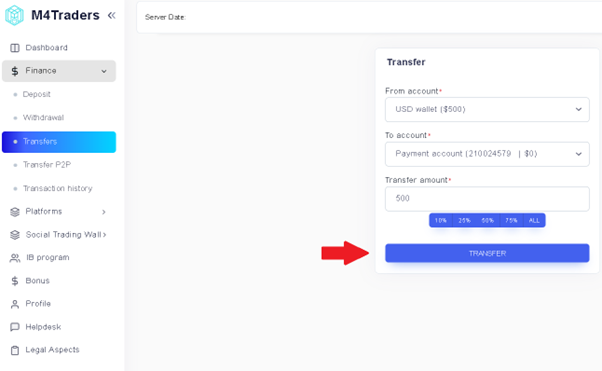

5. To transfer funds first select the account that you want to transfer from, then select your payment account, enter an amount to be transferred and click “Transfer”.

6. Go back to the Social Trading platform by following the steps on #3 or visit: https://invest.moon4traders.com/#/broker/dashboard

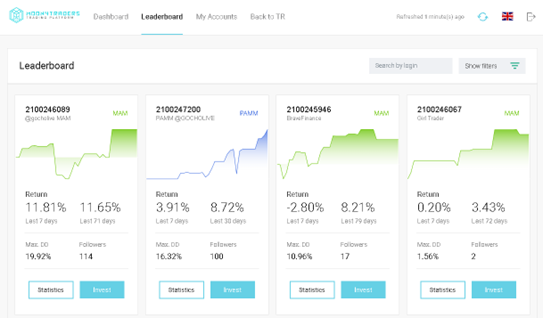

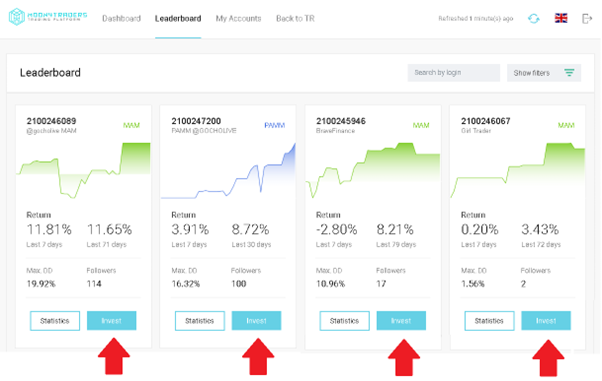

7. Click on “leaderboard” from the options on the top section of the Social Trading platform.

8. Once you have reviewed the available accounts to invest on and have made up your decision, click on “invest” on the desired Social Trading account of your choice.

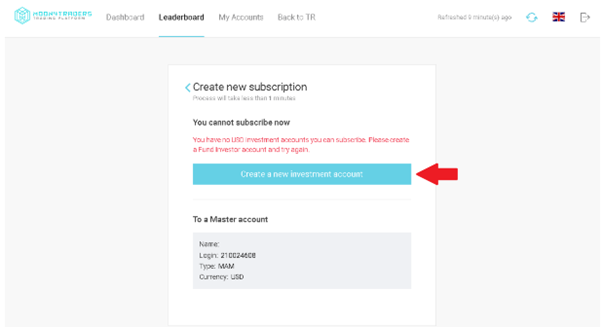

9. You will now have to create an investment account in order to subscribe to a social trading account, click on “Create a new investment account”

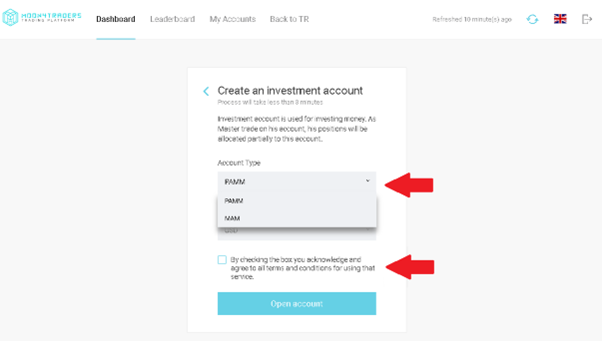

10. After that, you will need to select a type of account that you wish to open (PAMM or MAM) and agree to the terms and conditions, then click “open account”.

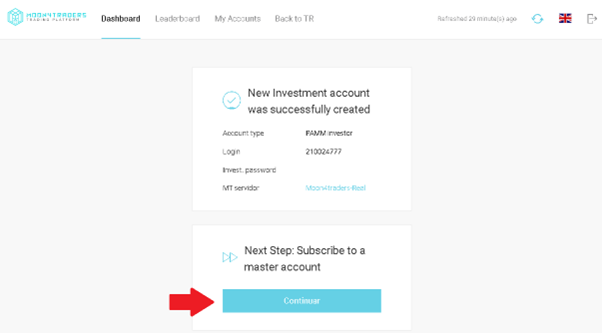

11. Finally, review your investment account’s information, you will shortly receive an email with your credentials for future reference. Subscribe and you are now a social trading investor!

Benefits for investors

- Make a portfolio of investments: subscribe to several masters simultaneously and get combined results in one account.

- Set a risk limit: limit your potential loss and stay calm. If something goes wrong, your subscription will be cancelled automatically.

- Instant subscription and unsubscription of traders. Don't wait until the end of the week or month if you want to stop following the master.

- Absolute control over the account: close positions opened by masters you do not like through the MetaTrader 5 trading terminal.

Benefits for experienced traders

- Higher income: at the end of each month you are paid with part of the earnings of your followers.

- No additional stress: You continue to operate with the same strategy due to the same size. There are no changes at all.

- Detailed statistics of your account with a good chart on the broker's website.

Create an investment portfolio with several traders

Why invest in one money manager’s strategy when you can invest in five, ten or even 15 traders and diversify your risk?

One or more may lose money, while the successful ones will profit and offset the losses. It is the same risk control approach that applies with stock trading.

Be part of our community of successful investors

Discover the difference with moon4traders. We are more than just a broker, we offer a unique investment experience with our loyalty program. Join us today and start taking advantage of exclusive discounts and rewards on every transaction.

Choose your language

Company Information: Moon4Traders LLC is incorporated in St. Vincent & the Grenadines as an International Business Company with registration number 1925 LLC 2022 and registered address: Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont -Kingstown, St. Vincent and the Grenadines.

Moon4Traders is authorised and regulated by the MWALI International Services Authority (IBC Regulation ACT 2014 Licence Number:T2023270)

Legal Information: Moon4Traders doesn’t provide services to residents of the following jurisdictions: Sudan, Syria, North Korea, Saint Vincent and the Grenadines, Cuba, Iran, USA and Canada.

Please read and accept the Risk Disclosure Policy and AML before you start trading.

Leveraged financial products carry a high risk to your investment. High market volatility or temporary market illiquidity may cause a loss of cash funds in excess of your deposit. Please read the Risk Disclosure carefully before proceeding.